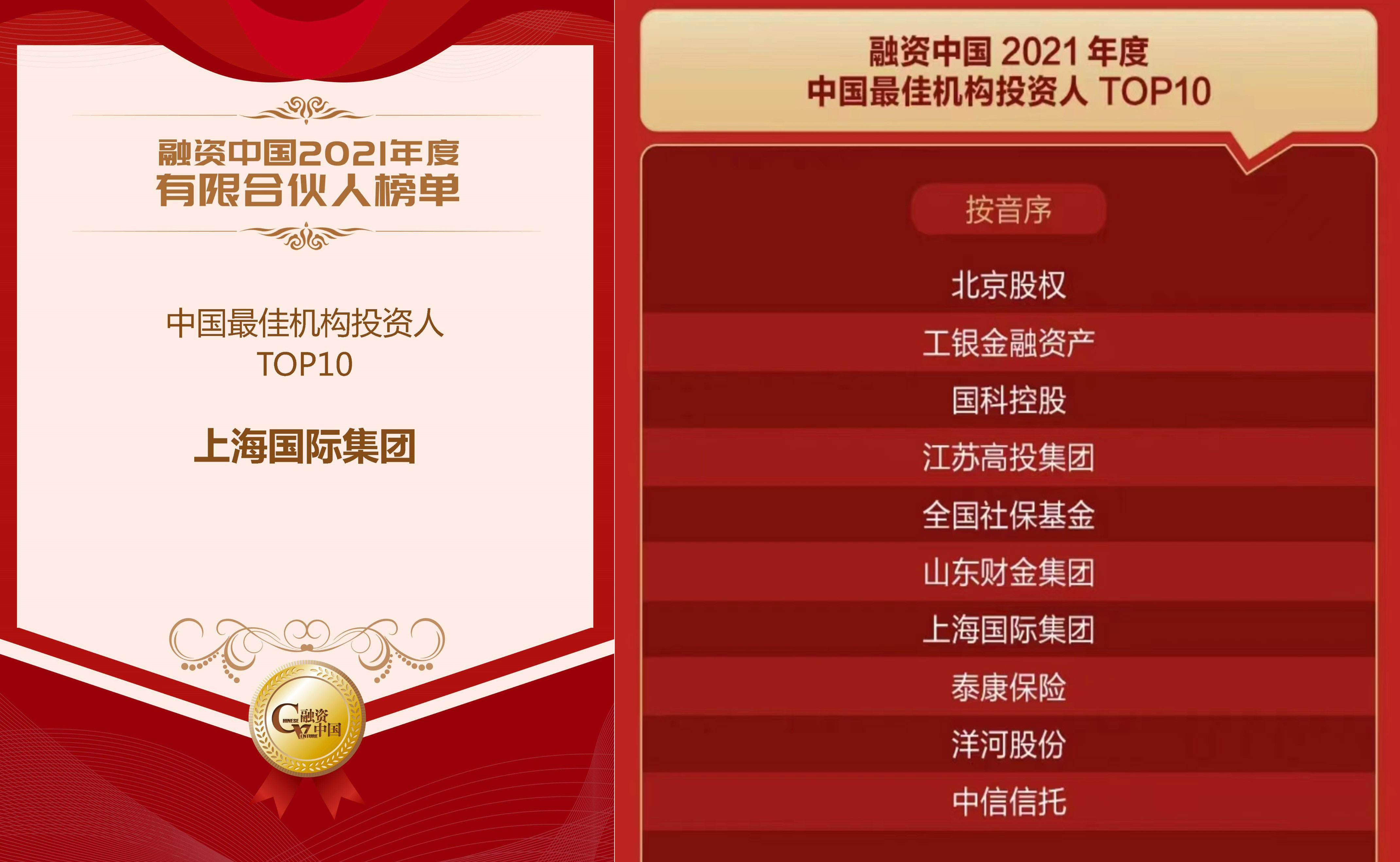

SIG Listed among "Chinese Venture" Best Chinese Institutional Investors 2021

- Recent reports

-

2023-04-28

Strengthening the Fulfillment of Responsibilities, Eliminating Potential Hazards: SIG Conducts Safety Inspection before "May Day" Holiday

Learn more

-

2023-04-27

Nearly 100 Invested Enterprises of SSC Selected into Global Unicorn Index 2023

Learn more

-

2023-04-26

Seizing Opportunity, Recording Lowest Coupon Rate, Enhancing Market Visibility: SSAM Successfully Issues First-Tranche MTNs in 2023

Learn more

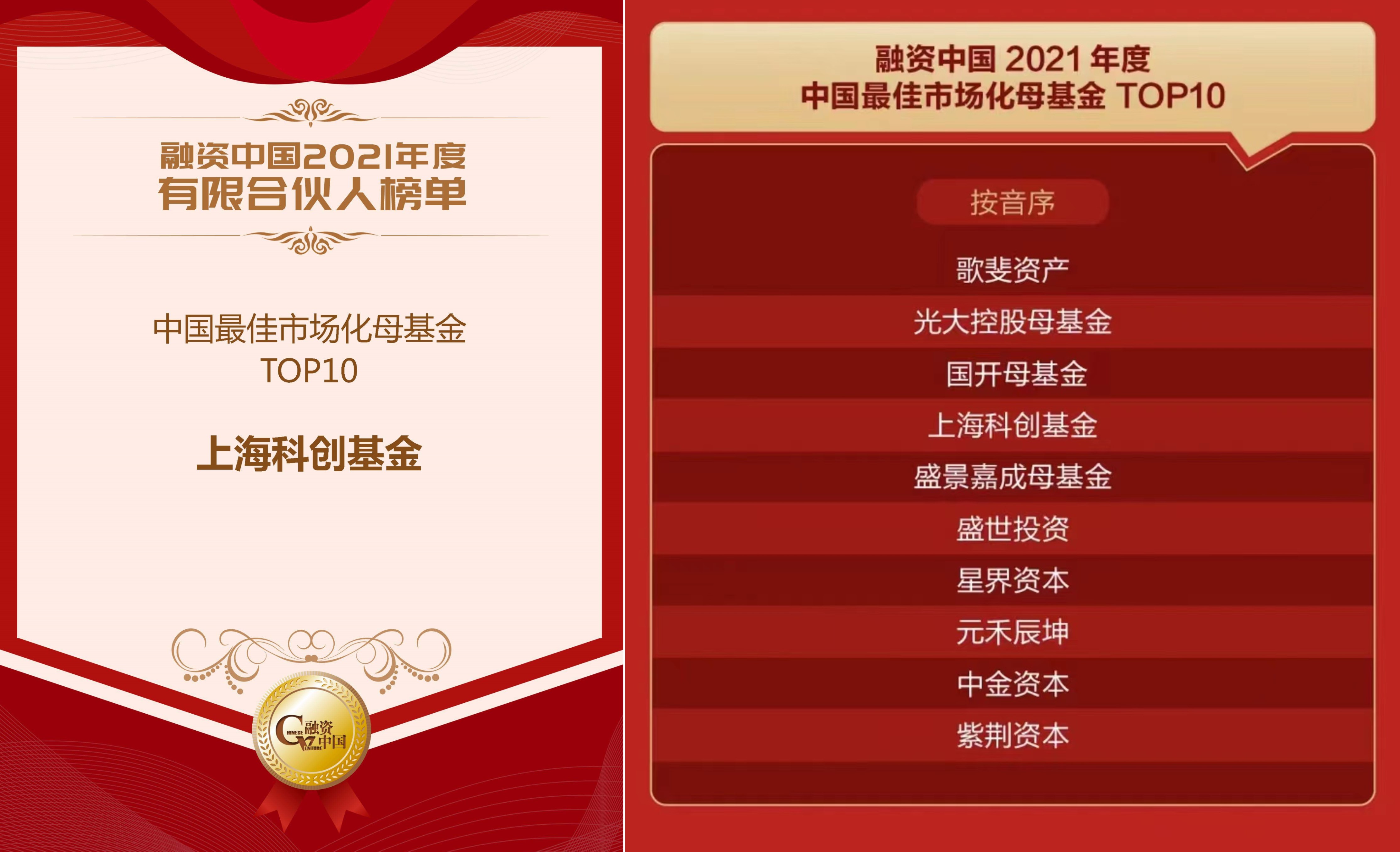

Recently the 2021 list of "Chinese Venture" Limited Partners has been released. SIG was ranked among the top 10 of Best Chinese Institutional Investors 2021 and Shanghai Sci-tech Capital under SIG among the top 10 of Best Chinese Market-oriented FoFs 2021.

Bridge Research has long followed the trends of PE investment, conducted scientific and rigorous research, taken a fair and impartial attitude in terms of ranking, used professional, scientific and quantifiable methods to objectively analyze the scale of investable capital of limited partners (LPs), the number and scale of their invested sub-funds and their comprehensive return levels, and finally worked out the annual LP list. It enjoys great influence and credibility in the PE industry.

With focus on the building of Shanghai International Financial Center and Shanghai Sci-tech Innovation Center, the internationalization of the RMB and the integrated development of the Yangtze River Delta (YRD), SIG has created five fund manager brands: GP, Guohe, Sailing, SSC and Growth, aiming to invest in some domestically and globally influential sci-tech enterprises in YRD, to promote the high-quality development of strategic emerging industries and high-tech industries. SIG has basically created an investment ecosystem in which direct project investment, direct investment funds and FoF platforms support each other, achieved significant results in supporting strategies and serving the real economy by market means, steered and driven the development of social capital, and realized the leading and amplifying role of state capital.

In recent years, SIG has earnestly implemented the decisions and plans of the CPC Shanghai Municipal Committee and the Shanghai Municipal People's Government, as well as the work requirements of the CPC Committee and Discipline Inspection Commission of the Shanghai Municipal State-owned Assets Supervision and Administration Commission. With focus on its primary responsibility and business: financial holding, state capital investment and operation, assets management, under municipal strategies such as building "five centers", enhancing "four functions" and advancing three major tasks, SIG has kept deepening its function as a state capital platform, improving its capabilities of investment and assets management, intensifying reforms and innovations, opening up new prospects for high-quality development, and improving the investment structure of mainly relying on finance with due consideration to strategic emerging industries. SIG's headquarters has accelerated the allocation of strategic assets in fields such as finance and technology. As a direct fintech investment platform under SIG, Guoxin Venture Capital has focused on fintech investment.

In the future, SIG will persist in market-oriented, specialized, internationalized and law-based development, make new achievements in high-quality development, endeavor to develop into a Chinese top financial holding group and a state-owned capital investment operation and assets management platform with important strategic functions and international vision and influence, and meet the 20th CPC National Congress and the 12th CPC Shanghai Municipal Congress by action.